Average Home Insurance Cost

The average cost of renters insurance was 180.

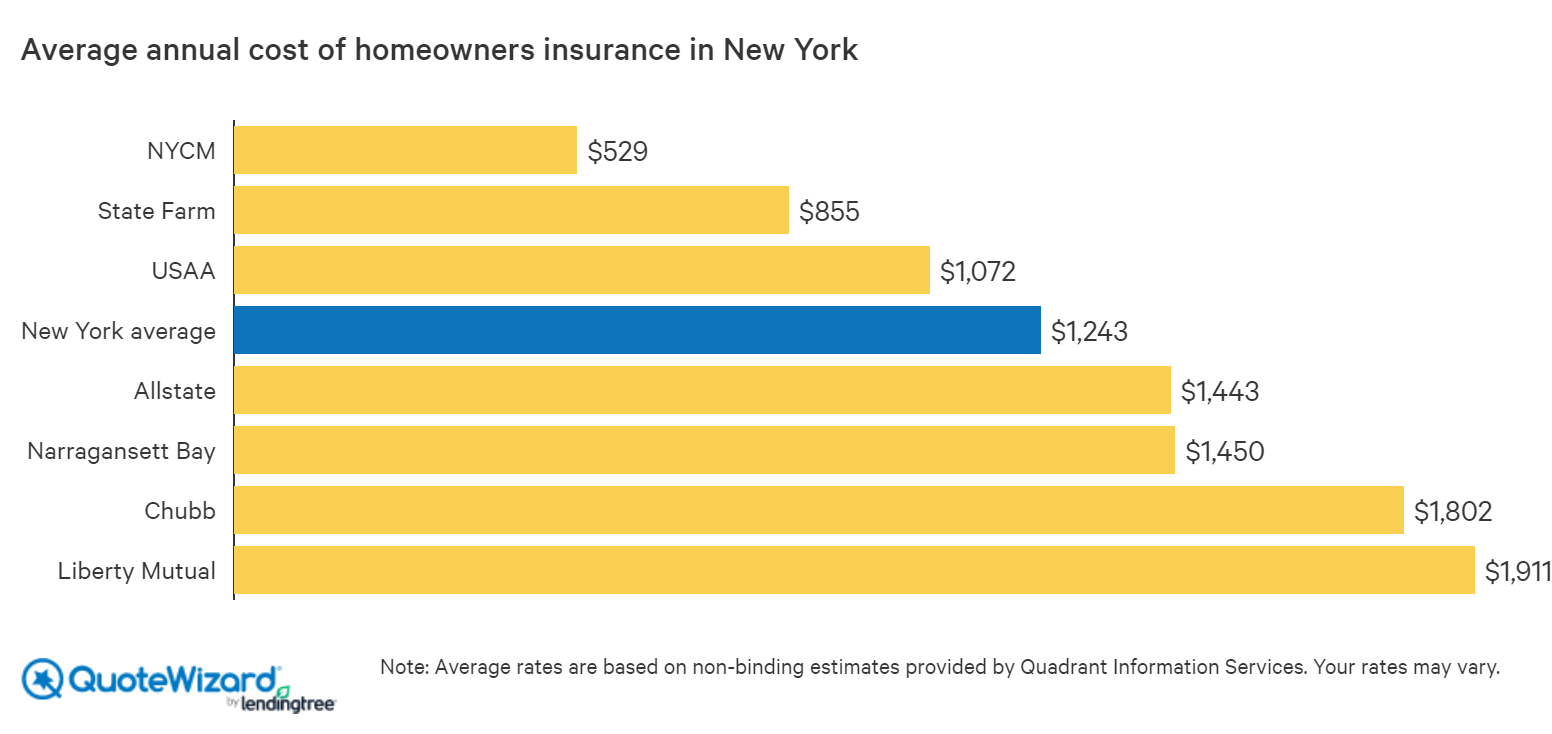

Average home insurance cost. Depending on where you live the average cost of home insurance can fall anywhere between 400 and 3000 per year. The average homeowners insurance premium in the united states is 1211 a year according to the naic. The average premium actually paid in the uk for home buildings and contents insurance was 307 in 2018 the latest data availablebut you might pay more or less in the market today depending on the rebuild cost of your home the excess your no claims bonus the features you want in a policy and even your claims history. These costs are impacted by the unique home insurance risks for each state the amount of coverage a typical homeowner buys in each state and several other factors.

Thats just 311 a week. The value of your home where you live and the coverage level you choose can all impact the. The average home insurance cost is 1192 a year according to the national association of insurance commissioners latest home insurance report. The national average cost of homeowners insurance was 1211 in 2017 according to the latest data from the insurance information institute.

Thats just 311 a week. For example our research showed. Average cost of home insurance. Texas and florida have the most expensive average cost of homeowners insurance based on the most common policy type called an ho 3 policy.

Average home insurance rates can vary a lot depending on where you live your deductible amount and the amount of coverage you need. Utah and oregon have the least expensive average home insurance cost. Thats why its important to have as much detailed information as possible when planning the home insurance basics for your budget. And you want to be sure you buy enough protection to fully protect your home so its wise to seek guidance to prevent your.