Student Home Insurance

With endsleigh you can build your student contents policy to include cover for gadgets against theft accidental and liquid damage while youre away at university.

Student home insurance. With contents insurance you can protect yourself against theft and even get cover for damage or loss. Student insurance is designed for students living away from their family home in halls of residence or rented accommodation while theyre studying. It insures the contents of your accommodation in case of loss. Contents insurance does exactly what it says on the tin.

Nowadays there is a huge necessity to protect yourself with home insurance for students. But you might want to check if any of your belongings are covered under your parents contents insurance particularly high ticket items like laptops. As a student the last thing youll want to worry about is having to fork out money to replace your stuff after a theft or burglary. The most basic student contents insurance will cover your belongings when they are in your house or halls.

Keep in mind that not all high value items such as laptops and bicycles will be automatically included in the cover. First of all becoming a student usually means moving into your first home which needs protection. Our business experts are available from. This will vary among insurance providers but in most cases your policy will cover you for any damage or theft of your belongings that takes place within your accommodation.

It is important in any case whether you live alone in a dorm or with a roommate. Our leading position in the field of online student home insurance allows us to offer you a wide choice of guarantees. Standard contents insurance will replace items affected by fire flood and theft. You might have lots of expensive gadgets such as laptops that appeal to thieves.

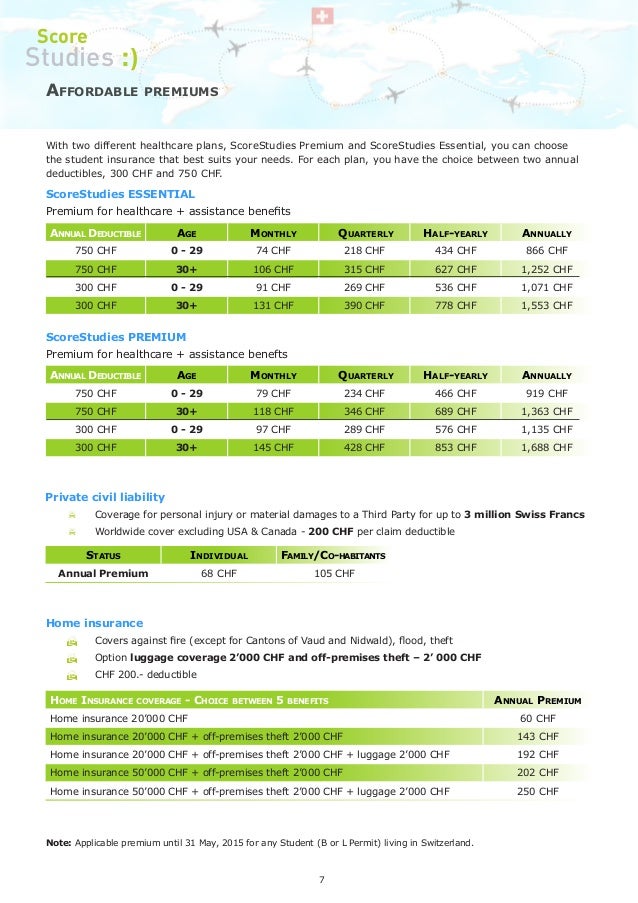

To do this we have designed 5 formulas and additional options to suit all your needs. There are a few simple steps you could take to lower your chances of getting burgled. This will normally protect you from theft loss general damage earthquakes lightning falling trees seriously and water damage. Student contents insurance is designed to protect your possessions from all the usual hazards but it also takes into account the realities of living in spaces shared by lots of other people many of whom you may not know very well.

We know that as a student you are on a tight budget so we negotiate our contracts with our partners to offer you solutions at the best market prices. You may need to call these out separately as valuable items on your policy so its worth checking with your provider. Choose the best way to apply for quote on home policy here.